Feed market – Spot Soya remains firm, forward buying remains the answer

By Colin Shepherd, Commodity Trader, Countrywide Farmers.

Colin Shepherd

Strong global demand has kept Hipro Soya prices relatively firm over the last year. It is advisable to take away the risk of the spot market by buying a percentage of what you need 3 to 6 months in advance of delivery. Many of our customers have already covered a decent percentage of what they need between May 2014 and April 2015.

It is possible to remove your reliance on the world’s major protein source through a change in nutrition by looking at more locally produced products such as Rapemeal, Distillers or higher protein Molasses. Alternative options available:

- Increase the use of Rapemeal, or Protected Rapemeal.

- Look towards the opportunity represented by Distillers, either UK produced or imported – Maize or Wheat.

- Molasses prices should ease during the summer, higher protein options will again be cost effective.

However, the key to underpinning your protein costs, regardless of what you use, is looking at the forward market and covering product when a buying opportunity presents itself.

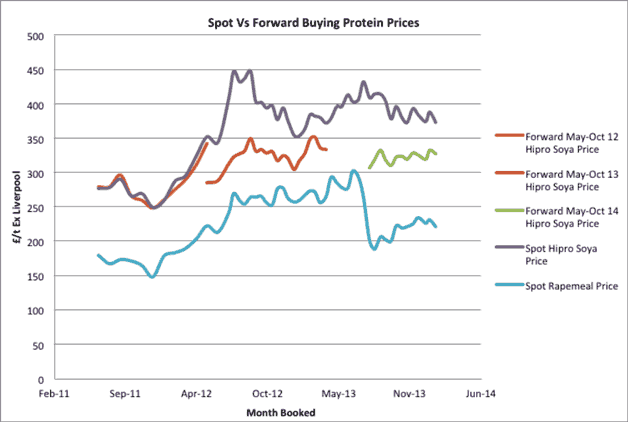

Over the last 10 years it has become increasingly important to remove the risk of exposure to spot markets, particularly when covering major protein raw materials. The following graph shows the benefit of buying forward, on average, versus leaving purchasing decisions to the last minute.

There are three main points to consider:

- Buying proteins forward will on average save 10-15% on feed costs.

- Over recent years one of the best periods to buy forward has been in December and January. This window has now passed and prices have picked up in the last few days.

- The correlation between Rapemeal and Hipro Soya is clear. However, there are occasions when one product offers far greater value; we have already had two or three opportunities to cover Rapemeal or Distillers at much better value than average this year. Keep close to your supplier to pick up on these opportunities.

What should be done now?

In the US, last year’s Soybean crop ended at 8.3% above the previous year, with an average yield at 43.3 bushels/acre. Currently, in South America, the Brazilian harvest is under way and the yield looks good, forecasts put crop this year at 89-91million MT, a significant increase of near 10% from last year. The Argentinian crop is also looking reasonable. These figures indicate that better prices should be available soon, however as mentioned earlier the world demand remains high and will continue to keep the spot market firm.

Advice for 2014

- April to July traditionally is difficult with availability of soya restricted by logistical issues out of South America. Cover that period now for your protein requirements, particularly up to the end of May.

- Forward prices are better, take a 25-50% cover now for August through to April 15.

- Leave some 50% of the August onwards as the potential of the South American crop proves to be as high as current predictions, better prices may come forward later in the year.

- Acting now should take away the exposure of potentially paying into the high £300’s for Hipro Soya and £230 plus for Rapemeal.